Warren Buffett once said, “The first rule of an investment is don’t lose [money]. And the second rule of an investment is don’t forget the first rule.”

Understanding why you are investing in the things you are investing in is crucial. It’s important to invest and diversify your portfolio in a way that will help you get closer to your financial goals and allow you to maintain peace of mind even in a recession. It’s easy to make money in a bull market, but it’s just as critical to not lose money in a bear market or recession.

As an apartment syndicator, I’m a strong advocate for apartment investing. Why?

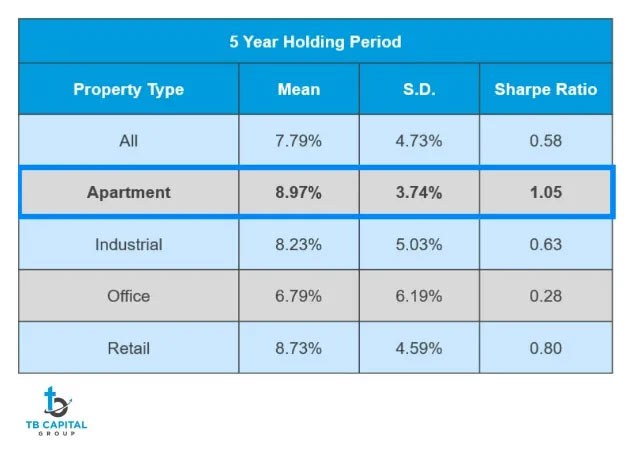

One major reason – apartments have the highest risk-adjusted returns out of all commercial asset classes.

Recession Resiliency

Investments that are resilient during economic downtowns are ones that service a basic need. Apartments satisfy one of those needs.

Consider that everyone has the same basic needs. Everyone needs to have a roof over their head, needs to have a place to sleep, food to eat, water to drink, etc. Affordable housing provides a UNIVERSAL and BASIC need.

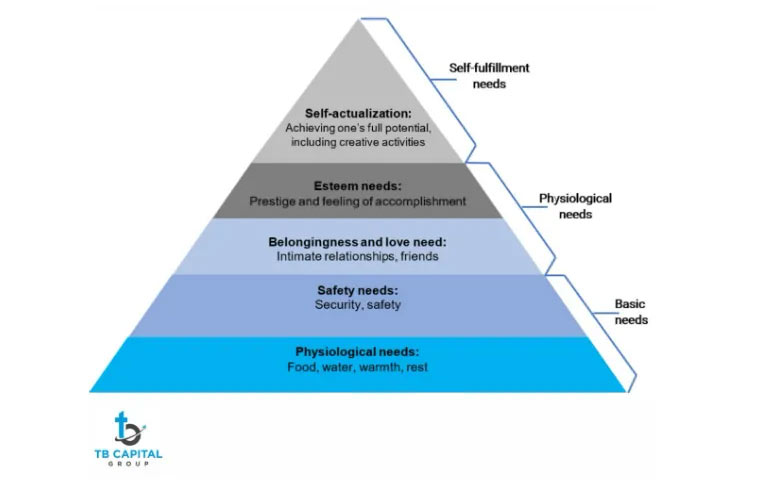

Your quality of life is a combination of health, comfort and happiness. Part of your quality of life concerns things that you want, and part of your quality of life are things you can’t live without. American psychologist Abraham Maslow proposed that everyone has a universal tier of “needs”, ranging from deficiency (basic) needs to growth (advanced) needs.

According to Maslow, our initial set of needs—our physiological ones—is what drives us. These include our biological requirements for human survival. This includes air, food, drink, shelter, clothing, warmth, sex, and sleep. If these needs are not met, he proposed that humans cannot operate at their fullest potential.

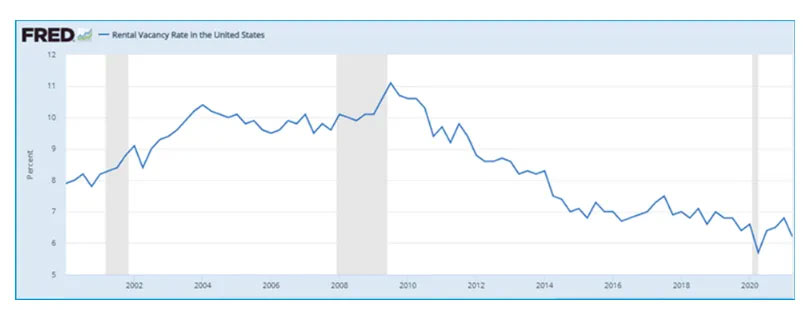

Figure 4. National rental vacancy in US. “Rental Vacancy in the United States.” FRED, 2021.

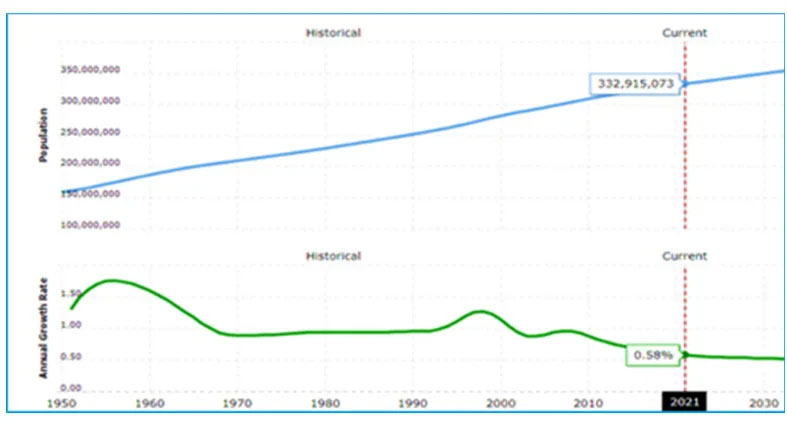

In addition to the aforementioned decline in vacancy rates, tenants are now renting longer than ever before. The average renter in the United States stays in a unit for 27.5 months, according to one survey conducted by ResidentRated.com.

Not only that but more US households are also renting than at any other time in the past 50 years, says Pew Research Center Census Bureau data. This increase in renters has happened across all levels of educational backgrounds.

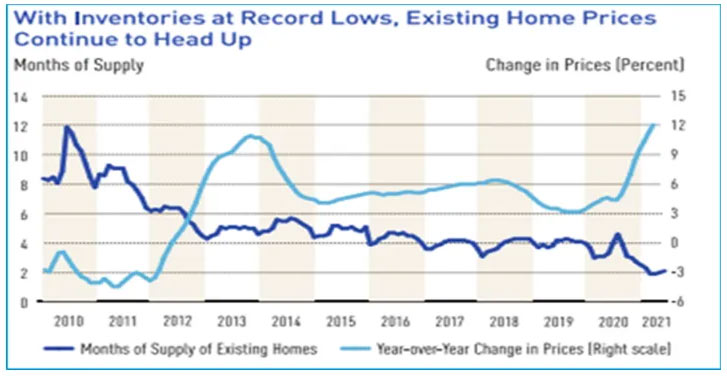

Clearly, rental units are becoming increasingly important for the US housing market.

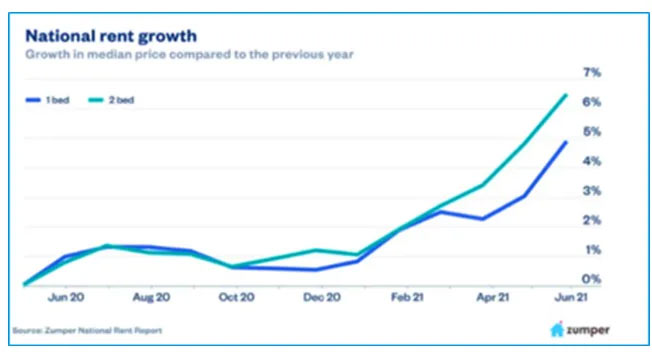

Figure 6. Growth in median price compared to the previous year. “National Rent Growth.” Zumper, 2021.

In Closing

Apartments are a great way to diversify your risk and growth. There are numerous ways to diversify solely within apartment investing, and investing in apartments entail a variety of financial options. You can also diversify by geography, by asset class, and by business plan to balance cash flow markets with appreciating markets.

There are numerous ways to invest in multifamily assets, whether you want to be passive or active in the day-to-day management. While this article provides you with a lot of reasons why apartments are a great asset class to invest in, there are several financial advantages to investing in apartments.

If you are considering passively investing in apartments, check out this free Passive Investors Guide to the Multifamily Universe.