TB Capital Group has a targeted investment focus on value-add apartment communities in growing markets. Through thoughtful capital improvements and operational efficiencies, TB Capital adds significant asset value.

ACQUISITION CRITERIA

-

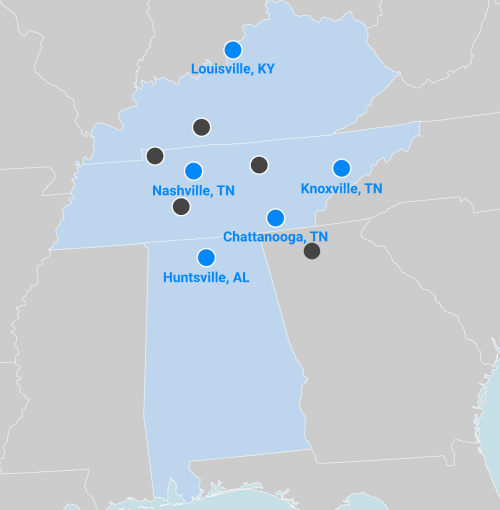

Target Markets: Properties located in Southeastern markets (Clarksville, Cookeville, Chattanooga, Nashville, Huntsville, Bowling Green, Louisville). *Considering other markets opportunistically

-

Asset Class: Class B/C property with opportunity for value addition through improvements

-

Asset circumstance: Underperforming, mismanaged, or distressed multifamily properties

-

Asset size: 50-200 Units; up to $25M purchase price

-

Returns and Exit Strategies: 3-7 year holding period. Liquidity event by year 5. IRR 13%+. Equity Multiple 1.8+, AAR 15%+, CoC 7%+

WHY PARTNER WITH TB CAPITAL?

QUALITY INVESTMENTS

We are constantly sourcing high quality deals so that you have a consistent selection of high-quality multifamily investments to choose from. We seek out apartments that are mismanaged, outdated, or distressed. We then rebrand and reposition by creating desirable apartment communities.

CONSTANT COMMUNICATION

We are open to answering all questions you may have and we will be there every step of the way through your investing journey with TB Capital. We provide reports to our investors to keep them in the loop of everything that is going on. Our investors are welcome to call us at any time.

BETTER INVESTMENT DECISIONS

Our goal is to provide you with the information you need to succeed. We have ample amount of education resources available at your fingertips and we are always striving to add more. You can check out our blog for weekly posts.