Real estate investing is one of the most profitable investments with a lot of potential for success. It offers many advantages, and investors can enjoy steady income flow that may lead to financial freedom. You have a lot of options when it comes to investing in real estate, specifically in Multifamily assets such as apartment complexes.

Investing in multifamily properties comes with considerable benefits and can help you diversify your investment portfolio. Below we dig into six reasons to invest in Multifamily.

-

Cash Flow

If you’re committed to growing your wealth, becoming financially free, or earning through retirement, then you’ll need an investment that provides cash flow.

To keep it simple, cash flow is the profit after you account for ALL expenses. Expenses include debt service, property tax, insurance, repairs, budgeting, all operational costs, management, and payroll payments that apply. You want your cash flow assets in your portfolio to be significant because you want to seize financial opportunities, offset living expenses, and achieve ULTIMATE freedom.

It would be nice if you could have a risk-free investment that produces periodic cash flow. Sadly, this investment does NOT exist. If someone brings you an investment that’s “risk-free”, RUN! While risk cannot be eliminated, it CAN be mitigated. Risks can be greatly mitigated in real estate if you are investing in assets that produce cash flow. Cash flow from your investment mitigates your downside risk.

Pro Tip: Speaking of real estate cycles, the best way to be prepared in uncertain times is to leverage responsibly and retain cash reserves. You must be able to service your debt. Even if you’re breaking even on cash flow, you’re still earning equity through principal pay down.

The relationship between cash flow and equity appreciation is generally inversely proportional. It’s hard to have a lot of both. If your investment has high cash flow, it’s probably not going to appreciate much. Conversely, if your equity appreciates greatly, you’re probably not going to get much cash flow.

With the right business plan, however, you can enjoy serious cash flow AND equity appreciation.

-

Equity Appreciation

Another way that apartments and multifamily assets benefit you financially is by providing equity appreciation. All things the same, this happens when you increase your property’s profitability. So, how do you determine this?

As a point of comparison, let’s examine how residential assets are valued. Pretend you want to know how much your home is worth. If you look your home up on any housing website, the estimate for your property is based on two distinct factors.

- What did your neighbor’s home sell for? This is to determine the value of your property on the marketplace as it is today.

- What was their square footage in relation to yours? This is to show how your asset stacks up to what else is available and whether or not that is comparable.

Commercial real estate is NOT valued this way.

One of the greatest aspects of commercial real estate is the value of the property relies on the property’s profitability. To illustrate this, take the following calculation:

- Income – Expenses = NET Operating Income (NOI)

- Asset price = NOI / Market Capitalization Rate (Cap Rate)

Here we see the property’s NOI, or profitability, is DIRECTLY proportional to its VALUATION.

Again, if you want to increase the value of your commercial property, simply increase its profitability. This can be done by increasing income (increase rents, add incremental income streams, implement utility payback programs, etc.) OR by reducing expenses (utility conservation programs, low flow fixtures and faucets, audit service contracts, etc.).

Fun Fact: Equity Appreciation contributes roughly half of your return on investment in value-add multifamily strategies.

One of the most attractive things about real estate is the ability to force equity into a property. This will allow you to enjoy significant equity bumps during capital events if you have a value-add strategy.

-

The Power of Leveraging Debt

Suppose you have $1,000,000 you HAVE to invest it, but there’s a catch—you can only choose between conventional and alternative assets. Would you rather:

- Buy $1,000,000 worth of stocks, or

- Buy $4,000,000 worth of cash-flowing real estate

Option 2 sounds pretty good to me! It wouldn’t be possible without the power of leverage. Leveraging credit from banks and money lenders to enjoy income from an asset that’s otherwise four or five times what you could afford is POWERFUL.

Through commercial mortgage-backed securities, private loans and debt funds, lenders enable real estate investors to acquire cash-flowing multifamily real estate.

It’s a common misconception that getting a loan for multi-million-dollar assets will be impossible. However, with the right team and plan, it’s not nearly as difficult as initially perceived.

Multifamily real estate has the highest risk-adjusted returns in its class with the potential to generate solid, consistent rental income, which helps investors earn the vote of confidence from lenders.

Consider the flow of money in a multifamily asset. You buy the property with a loan from the bank. Renters pay your mortgage, interest, insurance, property taxes, and expenses. You receive the bonus cash flow.

Therefore, if an investor can find a viable multifamily property with strong financials and characteristics that a future investor may pay more for, the investor should be able to secure suitable financing.

-

Hedge against Inflation

With inflation reaching record levels, multifamily investing is an attractive investment option. As the cost of goods and services required to build, maintain and repair multifamily assets, that cost is going to get passed along to the customer. Relative to numerous other commercial assets, apartments have short term leases. This allows the rising cost to be captured in the form of rising rents. It is the reason why we’re season record-setting rent growth in 2021 and 2022.

Due to inflation and ongoing supply chain issues, housing rents have been rising. Strong demand meets limited supply. With this, investors could allow new leases to capitalize on market rents and meet inflation head on. A key to its effectiveness lies in landlords’ ability to raise rents in markets with low vacancy rates, resulting in outpacing rising inflation and potentially increasing income to investors. This provides protection to apartments performance and evaluation.

In fact, construction costs have outpaced inflation in recent years. High construction costs imply increased replacement costs for buildings, making existing real estate investments more valuable.

-

Apartments and the “Scaling Effect”

Economies of scale are cost advantages that companies enjoy when their production is highly efficient. This is because costs are spread over a large number of products. Multifamily assets are no different. Multifamily assets benefit from economies of scale in numerous dimensions. Below are some examples:

Risk

Spreading your risk out amongst a higher volume of customers makes “going bigger” a great way to manage your risk. Consider a single family home as a rental. If you have a tenant, you are at 100% occupancy; if you do NOT have a tenant, you are at 100% vacancy. Compare that with a 100-unit apartment complex; if one tenant moves out, your vacancy rate is only 1% lower.

Acquisitions

The calories required to acquire a 20-unit apartment are nearly identical to acquire a 200-unit apartment complex. See the below list for an idea of all the milestones of acquiring a property. The energy required to execute these steps is largely the same regardless of property size.

- Creating LOIs

- Negotiating terms

- Assembling a team

- Broker interactions

- Lender interactions

- Insurance interactions

- Due diligence

- Property visits

- Trade-specific inspections

- Environmental reports

Management

The energy required to manage a small multifamily property is not much different than managing a large multifamily property. The asset manager still has the same scope of work—to coordinate with the property manager and execute the business plan.

However, this is another instance where “Bigger is Better.” If you acquire a 100+ unit property, you can afford dedicated onsite personnel. With this, asset management becomes MUCH more streamlined and makes managing the business plan much easier.

NOTE: You can accomplish a similar result if you have multiple small multifamily properties in a concentrated area and leverage the same property manager for all the properties.

If you are looking to real estate as an investment vehicle, you can reduce your risk, scale your deal pipeline, and scale your operations simply by going BIGGER.

6. Tax Advantage & Tax Strategy Benefits

“In this world, nothing can be … certain, except death and taxes” – Benjamin Franklin

I would be remiss if I ONLY covered the topline returns of real estate investments. One of the appealing aspects of owning real estate is it offers you tax advantage to keep more of your bottom line. When people refer to “tax advantage” or “tax benefit,” they are referring to the ability to defer or eliminate taxes.

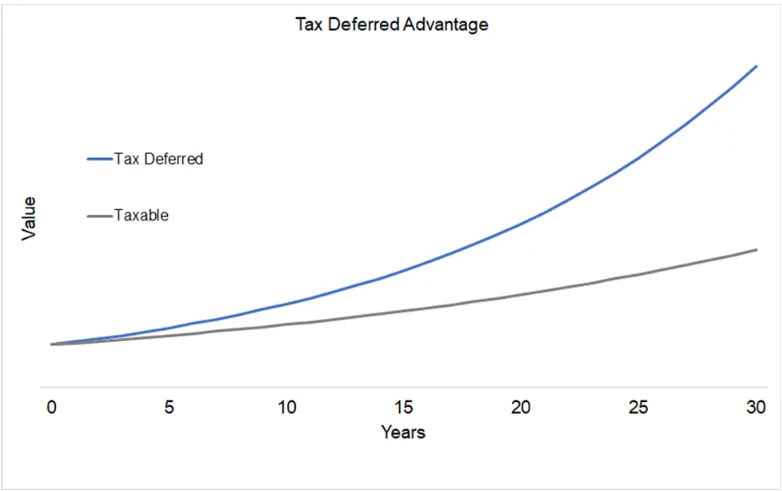

If we assume a salary of $200k, then $1.00 sheltered from tax is equivalent to $1.33 subject to tax of earned income. Now consider this effect over 30 years and across many transactions. Refer to the figure below for a visual of this impact from – tax deferred growth.

If tax planning is not a part of your wealth planning, you are planning to fail. We will explore some ways that real estate provides these benefits but also discover MORE tax advantages that are typically available only to commercial real estate.

The following are some examples of tax advantages that make multifamily investments more valuable to your bottom line.

Write Off Your Losses with Depreciation

The ultimate definition of tax advantages in real estate is the ability to write off your losses on your tax returns all thanks to owning property. The net result of your losses is that you’re able to keep more of the money that you make via real estate. What are losses? This can include depreciation of your assets, which is fairly common with long-term real estate investing.

The IRS acknowledges that some material used in housing, such as lumber, drywall, and paint, will eventually need to be replaced with time. They classify the cost of those materials as a loss for tax purposes.

Keep in mind, this does not mean that you are losing money by investing in real estate.

Instead, this is the most commonly known mechanism of depreciation, although in multifamily assets there are other “losses” that may be able to be claimed, such as bonus depreciation and cost segregation.

Your losses after depreciation and expenses are negative, which means you keep all of your cash flow and pass losses through to shelter other like-minded income. It’s not uncommon for depreciation to offset your NET cash flow, allowing you to enjoy your profits.

You’ll need to consult your CPA or tax attorney to help you during tax season to see which you can properly write off.

Write Off More Losses with Cost Segregation

Have you ever been caught in the middle of a conversation about how ridiculous it is that wealthy people end up paying so little in taxes?

Want to know the secret? It’s called cost segregation.

Cost segregation is the secret sauce that allows multimillionaires to pay low/no taxes. It also aligns well with the value-add business plans in commercial real estate.

For anyone who has constructed, purchased, expanded or remodeled any kind of real estate, cost segregation allows you to accelerate depreciation deductions and defer federal and state income taxes, thus increasing your cash flow.

This is done by breaking down and reclassifying certain interior and exterior components of a building, which are typically depreciated over 39 or 27.5 years, to be depreciated over five, seven or 15 years.

NOTE: While it is technically possible to leverage cost segregation in residential real estate, it typically doesn’t make sense unless the asset is a luxury or high-end home. In commercial real estate, however, cost segregation is very prominent and common.

Defer Taxes with the 1031 Tax Exchange

At the time of writing, the 1031 tax exchange allows you to “trade up” properties into bigger properties while deferring taxes until the time of sale. Generally speaking, when you sell an asset, you’re liable for any capital gains as a result of appreciation. These capital gains can be deferred, with a vehicle called 1031 exchange. This is where you use your proceeds or profits from one or multiple properties and use those pre-taxed dollars towards a down payment on another property.

Now, there are some requirements associated with this process and executing it. For example, you need to recognize that the time window to identify properties is 45 days. And then the time to execute the transaction with the down payment is 180 days. Additionally, this has to be executed with an appropriate custodian. If any of the money comes to you before being put to the next property, you will be taxed on it.

A 1031 tax exchange coupled with depreciation and cost segregation is the ultimate combination to grow your wealth tax deferred with real estate.

In Closing

Bottomline, multifamily investing has a lot of benefits and is also a great source of passive income. The large demand for rental properties has remained strong and are on the rise. This would definitely allow you to increase your potential for profit, and it would be a great option to diversify your portfolio. Just remember, the most important aspect of real estate investing is just getting started. Why not start with multifamily investing?

Check out this article for six ways you can invest in multifamily real estate.

If you want to learn more about multifamily investing, check out the resources on www.tbcapitalgroup.com