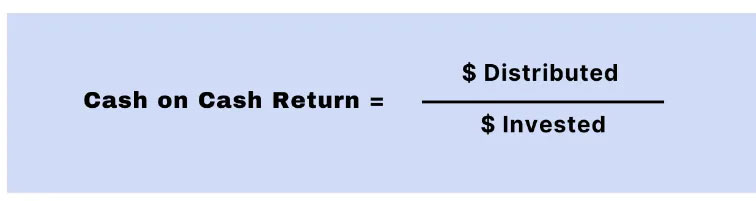

Cash on Cash Return (CoC)

Cash on Cash Return is the measure of how much cash you receive annually based on your initial investment. CoC is really a measure of your return ON capital. An investment with a cash on cash return of 20% (1 / 5) means it will take 5 years to recoup your initial investment.

Formula to determine CoC is below:

In Closing

Each return metric has its limitations of usefulness, which is why you can’t look at JUST one return metric. Looking at just one return metric could cause the investor to overlook a critical detail. An investor should be considering a number of return metrics for each offering. The risk profile of the investment’s business plan should be considered. It is important to note that the returns change based on your investment strategy. Generally speaking, you’d expect something with higher risks to yield higher returns. For an idea of investment strategies, check out our article HERE.

If you want to learn more about multifamily investing, check out www.tbcapitalgroup.com